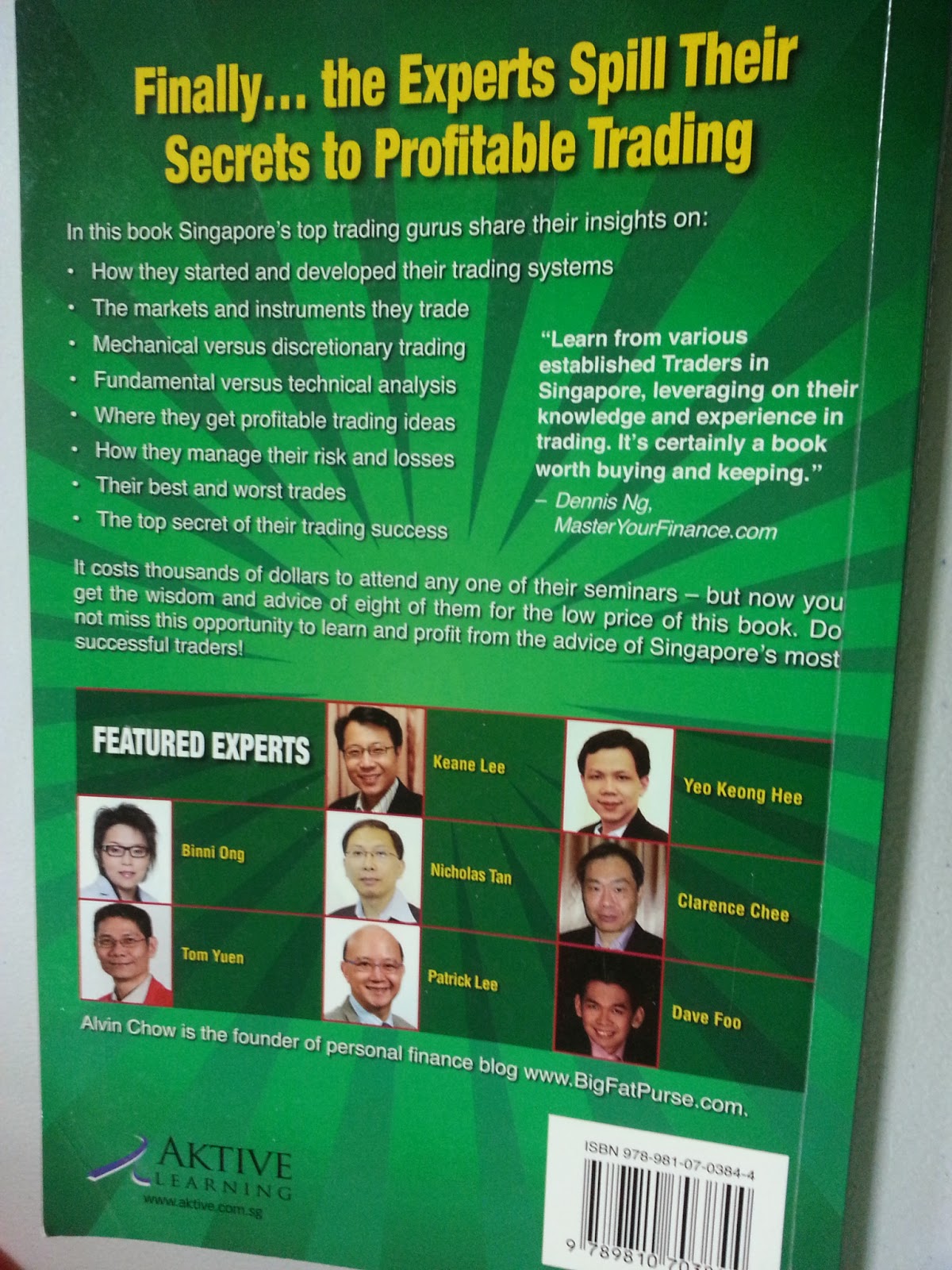

Secrets

of Singapore Trading Gurus - Alvin Chow

Hard Truths About Making Money in Stocks, Forex,

Futures and Options Trading

Keane

Lee - T3B Stocks, CFD

"If there is one secret, I would say it is to

let go of the emotional attachment to your money."

Edge: The most profitable way to trade is to get in

before the stocks start to trend. The next best way would be to buy stocks

where the smart money is already in. These are stocks that are in TREND and I

just need to take care of the downside while letting market decide how high it

wants to go. If I am wrong, I cut loss (below support price) and make sure I

only lose a little. When I am right, I want to maximise profits.

60-70% win rates. Cap losses to 8% ride trend profit

for 8-30% return

======================================================

Yeo

Keong Hee - Forex

"Yuo need to use your analysis tools in a way

which is different from the majority so that you are not part of the herding

instinct."

Edge: Good

trading strategy to capture trends (sub-trends and sub-sub-trends) or part of

the trends via Daily, H4 and H1 time frame. Use Moving Averages, RSI and

Stochastic but use it differently from public view.

Set of rules for entry (combination of economic

indicators, news events, TA and price action), exit (either winning or losing),

trading size in any one trade - position sizing.

Secret to success lies in how you think and feel

when trading (and not a holy-grail strategy). It is about convincing yourself

psychologically on your trading plan.

===============================================================

Binni

Ong - Tflow TerraSeeds Forex

"We do not want to look for a short term or

quick way to make money. We want a sustainable way of making money."

Elliot waves (entry), Fibonacci (exit) and price

pattern to detremine entry and exit

Break out methodology and retracement-based

methodology.

Use one main trading account and second micro

account after six to seven consecutive wins likely has ew lossess.

Secret to success would be belief. You have to

believe in the method that you use, or the path you are taking.

============================================================

Nicholas

Tan - Forex

"The important thing is not going after the

profit, but it is about looking after your losses. The profit will take care of

itself as long as you take care of your stops."

Be conservative when it comes to a loss and

aggressive when it comes to profit.

Constant trade size irregardless of capital. One or

two standard contracts per currency. Do not open more than 4 or 5 standard

contract per day. Keep maximum loss to

$2000 a day.

Secret to success is trading discipline. When there

is no trading signal, no trade to be done you should not be trading and it is

not a waste of time if you don't trade. Discipline applies to cutting losses too.

============================================================

Clarence

Chee - Forex and Index Futures

"Money is a by-product once you become a good

trader."

Daily chart and H4 time frame. 30% discretionary and

70% mechnical. Risk-reward 1:2. Risk 5% in

single trade.

Secret of success is first to learn how to be a good

trader not how to make money.

=============================================================

Tom

Yuen - Futures

"Do not spend a lot of money tryinf ro buy and

learn magic systems, as the answer lies within."

Derived own system from Darvas Box, Turtle System,

First-hour Breakout etc.

Vanilla Trading - buy and sell according to market

condition. Easy to understand but difficult way to trade

Spread Trading - buy and sell related or

semin-related products and Futures Expiry Roll Over spread.

Options Trading - directional or directionless

trades

Prefer Vanilla intraday Trading suitable for own

temperament.

Use

support-resistance lines, trend lines, channels, Simple MA, Point and Figure.

Position sizing using Rhythm. Once get a good rhythm

increase the size. When rhythm has been bad progressively reduce size until get

back in rhythm.

Two tier of daily trading loss limit. When first

tier loss limit hits check it was me or the market condition that was

unfavourable to determine whether to proceed or stop trading.

Floor traders are day scalpers and trading a very small

time frame no time to calculate risk reward.

Those who failed in trading "chicken

heart" (too much fear dare not pull the trigger) and "ninja" (no

problem firing trades but no problem holding onto losses).

To be successful enter with the right call with the

right position size. He has to be a risk taker and trading is his passion.

Some secret cannot be taught because it will no

longer work if others know about it. Eg. spread trading in Nikkei dollar-based

and yen-based after floor operating hours.

Secret: Learning how to trade is learning how to

live.

============================================================

Patrick

Lee - Futures Trading

"I can

decide how much money I want to make. But the market may not allow you to make

that amount of money and you have to accept tht and probably take a day

off."

Spread Trading - calendar spreading and inter-market

spreading between Topix and Nikkei. Day scalping on Simsci.

About 50 to 100 lots Simsci per day if market is

quiet and 200 to 300 lots if active. Target $1,000 to $1,500 a day.

Inter-Market Correlation Trading. Trade Simsci based

on HK, China, Japan, Korea, Taiwan and US to gauge buy or sell Simsci.

Especially Hang Seng Index. If all markets up long vice versa. Discretionary

decisions. Cut loss when correlation fails as 30% chance it doesn't work.

Average 17 profitable day out of 22 trading days per month. Per trade 1 to 5

lots. Account size $100k.

Trade Taiwan at night while cash market is closed or

S&P very liquid during the night.

===============================================================

Dave

Foo - Options

"This is what I mean by non-directional trading

- the market can go up, down or sideways, and I can still make money."

Trading against the trend on a low probability event

that is going to happen near term. Do not need a strong trend. Basically use a

simple Stochastic indicator for overbought and oversold to decide put and call

options. Sell a put option when indicator is overbought. Risk-reward 3:1.

Risking $3 for every $1 as there is a premium collected when selling option on

US market commodities or futures. Look at probability has at least 90% chance

of profiting before taking it.

Edge: Apply mathematical probability calculator.

Estimate capital $100k for $5k profit a month.

Secret of success: Support from your family is the

most important. Start slow and don't be greedy.

=====================================================================

Send Friend Requests to https://www.facebook.com/meetup.fx

=====================================================================

Follow us at facebook https://www.facebook.com/meetup.singapore

Send Friend Requests to https://www.facebook.com/meetup.fx