========================== 17May14 =========================

Setup for Market Crash

MIAMI (MarketWatch) — This is how bear markets begin.

Two months ago, I pointed out that the U.S. stock market had topped out and was going through a churning process.

Since that observation, the Dow Jones Industrial Average DJIA +0.27% has risen a bit higher but the Nasdaq COMP +0.52% and Russell 2000 RUT +0.63% indexes have dropped below their 50-day and 100-day moving averages. It’s only a matter of time before the Dow follows.

Bond yields may signal a warning

Yields on 30-year Treasury bonds have fallen this year, which could be a signal that economic growth will not heat up anytime soon.

Bear markets start with a whimper or a bang. When it starts with a bang, the first clue will be a major break in the market that no one can correctly explain. That will eventually be followed by a correction (or crash), and everyone will know that something bad has happened. The indexes will fall by double digits, investors will panic, and stocks get slaughtered.

Investors will be told to stay calm and not sell — but they will when the financial pain gets too great. They are also told that the market always comes back (although not all stocks will). Anxiety turns to fear as the market plunges. After a correction or crash, investors look for scapegoats while commentators ask, “Who could have known?” (Hint: Those willing to act on the clues and indicators were out of the market well before the most damage was done.)

But when a bear market starts with a whimper, it confuses nearly everyone. A meandering, volatile market is frustrating. At first, bulls are hopeful that the market will keep going up, but eventually, the market tops out and retreats.

I call this “death by a thousand pullbacks.” Instead of new highs, the market will make a series of short-lived but painful pullbacks. At first, the buy-on-the-dip investors will enter the market with new orders. As the bear market continues, the buy-on-the-dip strategy will stop working (along with most other long strategies).

Typically, a market making new highs is a healthy sign. In a looming bear market, new highs on lower volume is a red flag. That’s happening now. Also, leading technology stocks have gotten smashed, replaced by new leaders. After these new leaders fail there will be nowhere to hide.

Confusion and illusion

You may have noticed that some financial analysts on television seem confused. One week they make a bearish prediction, then reverse course. This is typical as the market transitions to a bear market.

Many commentators are confused because what has worked in the past stops working. Also, the behavior of other assets such as bonds and commodities don’t make sense. That’s a clue the market is entering a danger zone. Another red flag: Investors are buying stocks on margin at levels higher than in the previous peak years of 2008 and 2000. Whenever margin reaches excessive levels, bad things happen to the stock market.

Short-term, the market could churn higher. As prices rise, a lot of people will be fooled, especially if the Dow continues to make all-time highs. Many investors will not sell because they think they can either get out in time, or buy and hold through the next pullback or correction. The most aggressive investors will buy on the dip because stocks “are so cheap.” I’ve heard some financial commentators recommend that retail investors avoid a bear market by being “better stock pickers.” Ridiculous.

Here’s some advice: Rather than trying to be a stock-picking genius, before a bear market shreds your portfolio, think about getting out of the market even if you’re early. I’d rather give up 5% potential upside than risk 20% downside (or more).

Right now, the strongest case for the bulls is the Fed. And yet, in the history of the stock market, no institution has been able to prevent a bear market. You can’t fool Mother Market.

Waiting for the pivot point

Eventually there will be a pivot (or inflection) point, and the market will snap. No one knows what the catalyst will be. It could be an economic event, a geopolitical crisis, or a spike in interest rates.

When the market snaps, nearly everyone but the biggest believers will realize the market is in trouble. By that time, there will be a mad rush for the exits as everyone attempts to sell at once.

No matter how many times you tell investors to be wary of a dangerous market, most don’t listen. Based on the clues, indicators, and personal observations, crunch time is getting closer. No one knows when, but I am certain: a bear market is inevitable — sooner rather than later. This is not doom and gloom. It is market reality.

Michael Sincere (www.michaelsincere.com) is the author of “Understanding Options,” “Understanding Stocks,” and “Predict the Next Bull or Bear Market and Win.”

================================= 14Apr14 ========================

http://solarcycles.net/2014/04/13/set-up-for-a-stock-market-crash/

Set Up For A Stock Market Crash

Last week I posted 30 bearish indicators here. Since then equities have begun to sell off and change trend after historic and solar-maximum inspired levitation. There is a long way to go to mean-revert, wash-out or fulfil these indicators, but that can be achieved in a shorter timescale with the help of HFT by way of a crash or waterfall declines.

Within that list of indicators we see identification similar to the backdrop to the May 2010 flash crash, and I posted about that here.

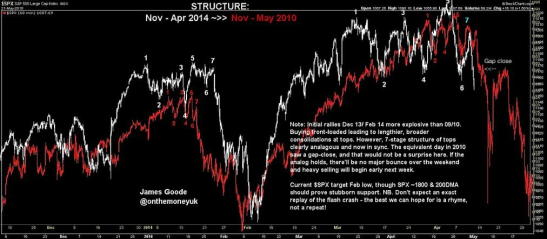

We see a similar price pattern into the flash crash repeated here too:

Source: James Goode

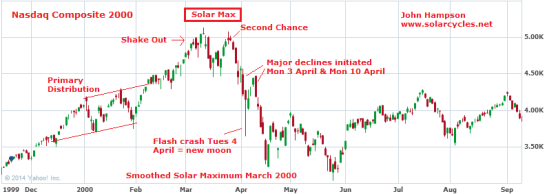

We also see identification similar to the Nasdaq peak in 2000, before a flash crash and waterfall declines:

And the same applies to the Nikkei 1989 and solar maximum.

Additionally, recall that major declines in history have often initiated following a weekend, where equities sold off into the Friday close, and market participants have time to stew Saturday and Sunday. Stocks sold off into the close on Friday, in a fairly decisive Thu-Fri trend change.

Recall that the biggest decline days in history have typically occurred close to new moons and full moons. This coming Tuesday is a full moon.

Recall that geomagnetism is bearish for the stock market. We have been experiencing geomagnetic disturbance both Saturday and Sunday this weekend.

Recall that periods of heavy falls in the stock market have typically occurred in the inverted geomagnetic seasonal lows of March/April and October. This is April.

In short, the set-up is here for a crash or waterfall declines, and the greatest potential lies in Mon April 14 – Tues April 15 (tomorrow and Tuesday) for a major historic down day. I balance that with certain short term indicators suggestive of bounce potential, and were that to occur we might look to around the new moon of April 28th for fulfillment. But the crash set up is there for tomorrow, so let’s see.

Http:// www.seehowitrade.com

No comments:

Post a Comment